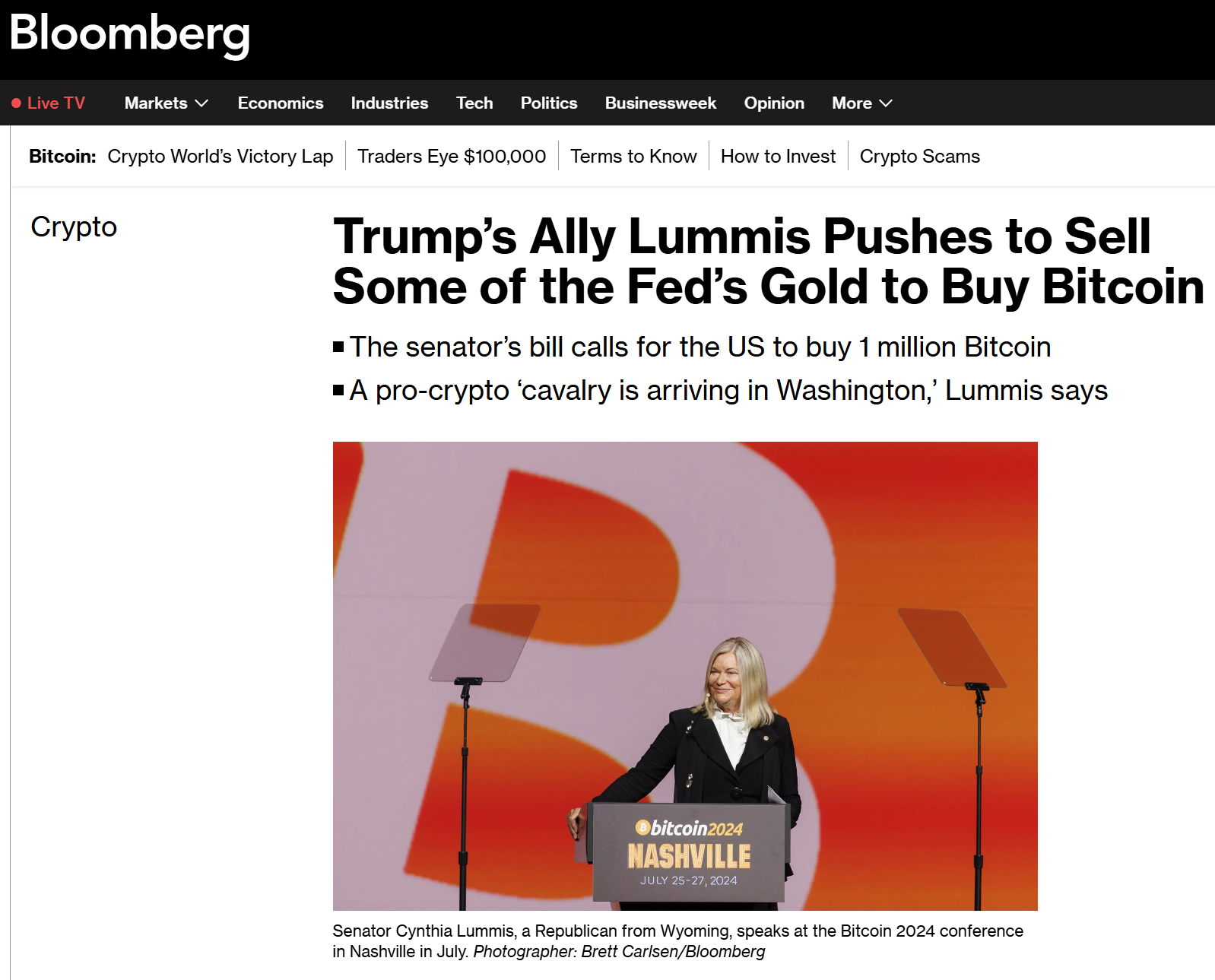

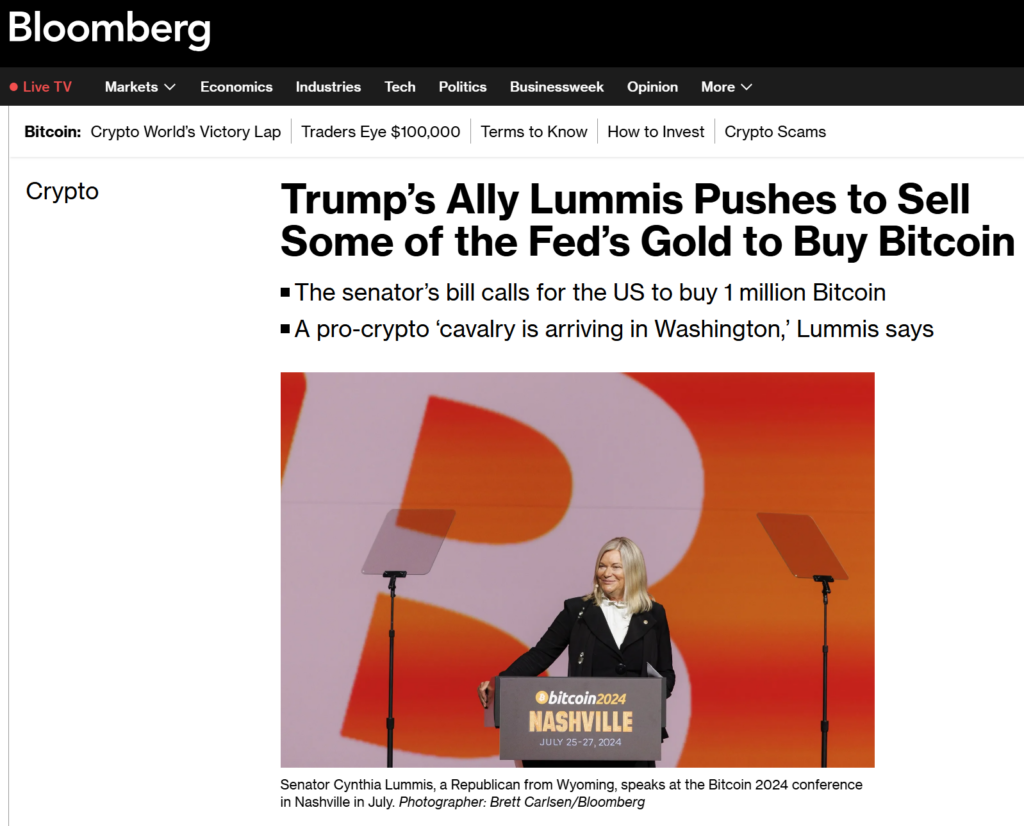

Senator Cynthia Lummis of Wyoming, a staunch ally of Donald Trump, is pushing forward a bold plan to help fund the U.S. government’s proposed strategic Bitcoin stockpile without adding to the national deficit. Lummis plans to introduce a bill in the new Congress next year, which would sell off some of the Federal Reserve’s gold to acquire 1 million Bitcoin—nearly 5% of the total supply. The move is intended to help fill the U.S. Bitcoin reserve while keeping the government’s balance sheet neutral, as the gold certificates used to acquire the Bitcoin are already part of the federal assets.

The proposed Bitcoin acquisition would cost around $90 billion at current market prices, though that figure could increase if the bill passes. Lummis believes that the strategic reserve will appreciate over time, potentially helping reduce the national debt. The plan builds on Trump’s earlier vision for a government Bitcoin reserve, which would leverage the approximately 200,000 Bitcoin currently held by the U.S. from asset seizures.

While the bill faces skepticism from some market watchers, including financial experts concerned about Bitcoin’s volatility, Lummis remains optimistic about garnering support from a new Congress that includes more crypto-friendly lawmakers.