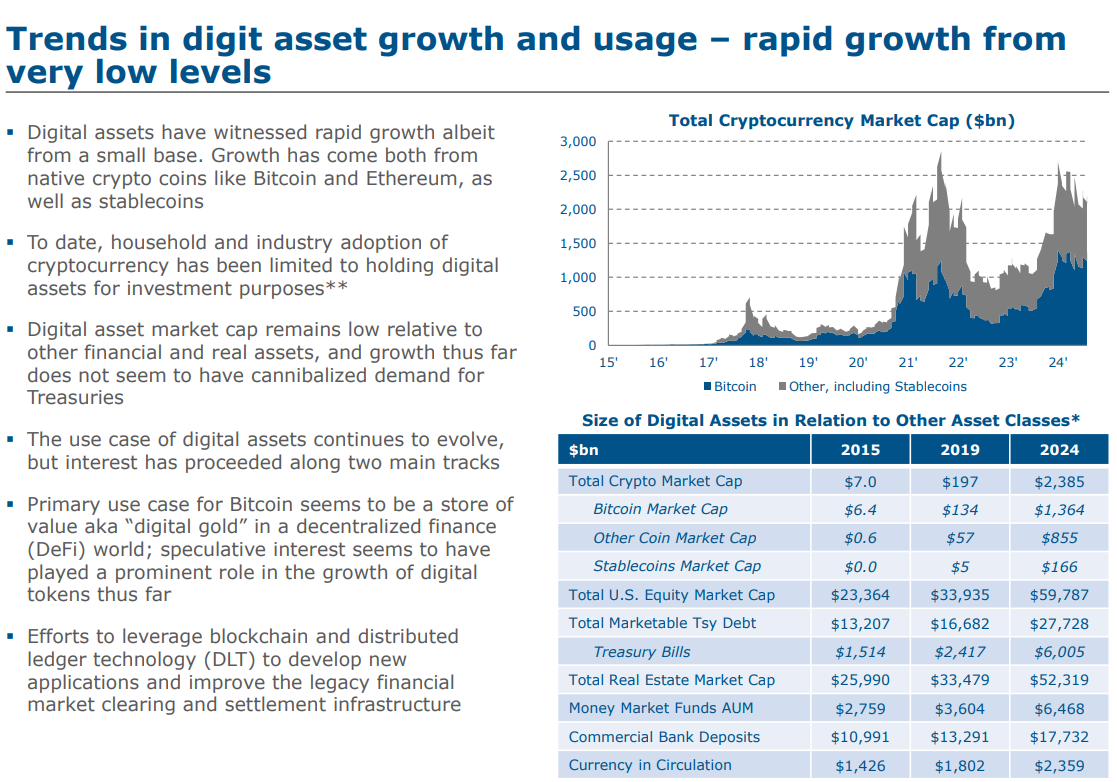

Looking at the U.S. Treasury’s market analysis from 2015 to 2024, an extraordinary parallel emerges between Bitcoin’s evolution and gold’s historical role. The data tells a compelling story of Bitcoin’s journey to becoming “digital gold” in the decentralized finance (DeFi) world. From a modest market cap of $6.4 billion in 2015, Bitcoin surged to $1.36 trillion by 2024, marking one of the most remarkable asset growths in financial history.

What makes this particularly fascinating is how Bitcoin’s primary use case has solidified around being a store of value, mirroring gold’s traditional role in the financial system. The U.S. Treasury’s data demonstrates that Bitcoin hasn’t disrupted traditional treasury markets but instead has carved out its own niche as a digital store of value. This suggests that, much like gold, Bitcoin is being viewed as a complementary asset rather than a replacement for conventional financial instruments.

The growth pattern shown in the market cap chart, especially the distinction between Bitcoin and other digital assets, including stablecoins, further reinforces this narrative. While the entire cryptocurrency market has expanded to $2.38 trillion by 2024, Bitcoin has maintained its dominant position as the primary digital store of value, much like gold’s historical standing in the traditional financial world. This trend indicates that in the digital age, Bitcoin is increasingly fulfilling the role that gold has played for centuries – a refuge of value in an ever-evolving financial landscape.